The Ultimate Guide To Employer Identification Number (EIN) - DOT Operating Authority

EIN? What is that? Employer Identification NumberYes, you need one- Biz Start-up Pro

Employer Identification Number (EIN) - DOT Operating Authority for Beginners

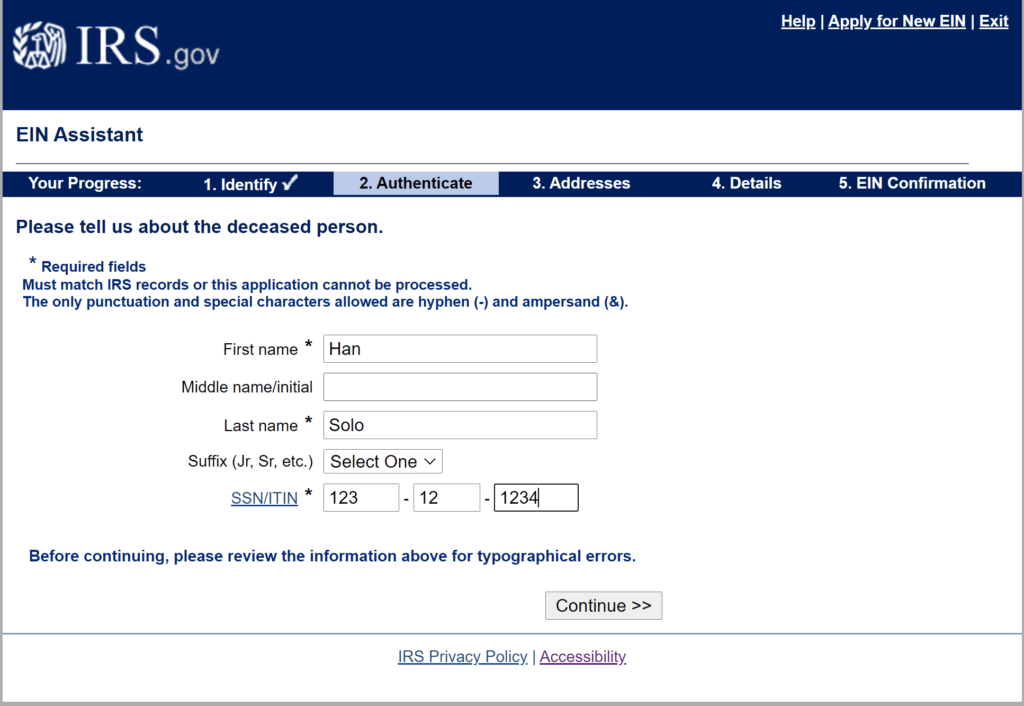

When your service is formed, you might look for an EIN number. The internal revenue service will request your company structure and formation date on the application. You can get an EIN number online through the IRS site which you can reach by click on this link. There are some exceptions to who is eligible for processing an online application that the internal revenue service site linked above will clarify.

As we pointed out above, not all TIN options use to businesses, and not all services require an EIN. If you are a sole owner or single-member LLC, you are eligible to use your social security number as your TIN. If you have a multi-member service structure or dream to protect your identity and prevent the usage of your Social Security number, you are eligible for an EIN.

Implications for Foreigners in the IRS Revision to the EIN Application - Iacone Law, P.A.

Some Ideas on Update Federal Employer Identification Number - Sunbiz Forms You Need To Know

Unless the applicant is a federal government entity, the accountable celebration must be an individual." Note: there can only be one responsible party per EIN. So You've Obtained Your EIN, What's Next? Now you understand what an EIN number is, what EIN stands for, and for how long it takes to get an EIN.

If you've taken the required actions to get your EIN, you may be thinking, now what? After you have received your EIN number it's time to start collecting the needed pieces to forming a main business. Now, it may be time to: Beginning a brand-new service is an amazing endeavor, and these information comprise the less attractive side of entrepreneurship.

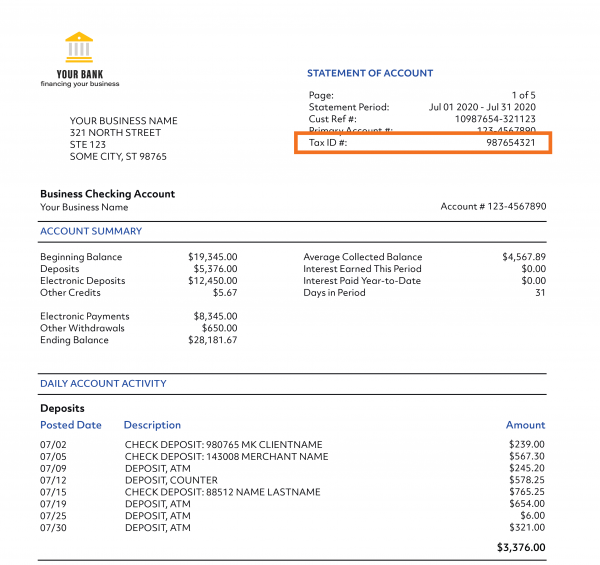

Fake Bank Statement 2 2 Unconventional Knowledge About Fake Bank Statement 2 That You Can't - Confirmation letter, Doctors note template, Lettering

How Do I Apply for an EIN, aka Federal Tax ID Number - IncNow for Dummies

An Employer Identification Number (EIN) is an unique nine-digit recognition code issued by the Irs (IRS) to a service. Find More Details On This Page follows the format 12-3456789. It is utilized for filing tax returns, opening a checking account, and working with workers. Synonyms An EIN passes numerous names. All the following describe the very same ID for your service: Company Recognition Number (EIN) Federal Company Identification Number (FEIN) Federal Tax Identification Numbers (TIN) What is an EIN Used For? Despite the fact that it's called a Company Identification Number, an EIN is not just for companies that have workers.